What if it shows decrease in gross profit margin please also give me some. Can you tell me what are some of the reasons for the increase in gross margin.

Profit Margin Formula How To Calculate Profit Margin Ratio

Gross Profit Margin Definition Formula How To Calculate

Difference Between Gross Profit And Gross Margin Difference Between

Net income was 19965 billion for the period highlighted in green.

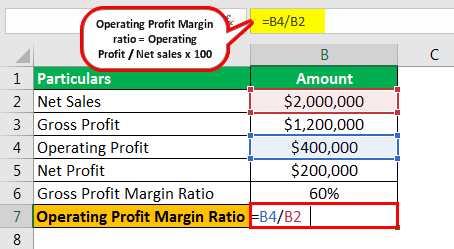

Gross profit margin interpretation. What is Operating Profit Margin. As part of profitability ratios apart from the Gross Profit margin another important ratio is the Operating Profit Margin. Net profit margin provides clues to the companys pricing policies cost.

Gross margin operating margin and net margin. Gross margin ratio Gross profit Net sales. The formula of net profit margin can be written as follows.

The operating profit margin is more complete and accurate than the gross profit margin in measuring the companys profitability performance. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Higher risk that a decline in sales will erase profits and result in a net loss.

Apples net profit margin is calculated by dividing its net. The net profit margin ratio also called net margin is a profitability metric that measures what percentage of each dollar earned by a business ends up as profit at the end of the year. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales.

37 Full PDFs related to this paper. Gross profit measures the dollar amount of profit from the sale of a businesss product. Net profit margin is the percentage of revenue left after all expenses have been deducted from sales.

The operating margin ratio Operating Profit Margin Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations prior to subtracting taxes and interest charges. Learn how exchange rates fluctuate. These ratios help in understanding if the company is making sufficient profit from its operations.

Sources of Income or Sales. Tweet When I analyse the gross profit margin by comparing to previous accounting period I found that there is an increase in gross profit margin. This café owner has a higher contribution margin from selling coffees but the muffin sales are much more profitable 83 vs 60.

Net profit margin formula is. The relationship between net profit and net sales may also be expressed in percentage form. The contribution margin concept is the recommended method of analysis since it yields a better view of how much money a business actually earns from its sales which can then be used to pay off fixed costs and generate a profit.

Its the amount of money you make when you subtract the cost of a product from the sales price. When dealing with dollars gross profit margin is also the same as markup. The measurement reveals the amount of profit that a business can extract from its total sales.

In business gross profit gross margin and gross profit margin all mean the same thing. Gross Profit Margin Gross Profit Margin Gross Profit Margin is the ratio that calculates the profitability of the company after deducting the direct cost of goods sold from the revenue and is expressed as a percentage of sales. Its only when you calculate percentages that profit and markup become different concepts.

A 30 percent gross margin is very low in some industries or sectors but it is on par or even high in others. A low profit margin indicates a low margin of safety. A short summary of this paper.

The following data has been extracted from income statement of Zain Maria corporation. Gross profit margin Y1 265000 936000 283 Gross profit margin Y2 310000 1468000 211 Notice that in terms of dollar amount gross profit is higher in Year 2. In general the contribution margin tends to yield a higher percentage than the gross margin since the contribution.

Profit Per Unit 013 or 13 cents Therefore ABC Ltd made a profit of 13 cents per unit during the year ended on December 31 2018. Both product lines are delivering value for the café with relatively high margins but higher profits could be achieved if the café focused on selling a higher number of muffins. Net Interest Margin NIM is a profitability ratio that measures how well a company is making investment decisions by comparing the income expenses and debt of these investments.

The formula of gross profit margin or percentage is given below. Net sales or revenue was 84310 billion highlighted in blue. The net profit margin is intended to be a measure of the overall success of a business.

Exchange rates float freely against one another which means they are in constant fluctuation. When gross profit ratio is expressed in percentage form it is known as gross profit margin or gross profit percentage. Upon review of the other numbers we see that this couldve been due to seasonality see more below andor an increased marketing expense.

It is the dollar amount of sales revenue you have left after paying all the direct costs of producing your product. Profit and loss report often referred as PL report income statement or statement of operations is one of the primary reports in the system of enterprise accounting which plays an important role in the financial statement analysisIt contains summarized information about firms revenues. When it is shown in percentage form it is known as net profit margin.

The gross profit margin for Year 1 and Year 2 are computed as follows. Full PDF Package Download Full PDF Package. Profit and Loss Report.

In this resource let. The contribution margin ratio shows a margin of 83 50006000. Analysis and Interpretation General information on profit and loss report.

ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS. Gross margin measures by percentage what part of the products cost is the sales price. Companies track three different profit margins.

Download Full PDF Package. This is because this ratio considers direct and indirect costs such as selling general and administrative expenses SGA expenses. Gross Margin can vary drastically between industries.

In this example we see that June was the best month in terms of sales gross profit net income and profit margin. Gross profit is equal to net sales minus cost of goods sold. From 2000 to 2018 35 large pharmaceutical companies reported cumulative revenue of 115 trillion gross profit of 86 trillion EBITDA of 37 trillion and net income of 19 trillion while 357 SP 500 companies reported cumulative revenue of 1305 trillion gross profit of 421 trillion EBITDA of 228 trillion and net income of 94 trillion.

Net profit margin measures how much of each dollar earned by the company is translated into profits. Declaring margins low is relative. In other words it shows how much net income a business makes from each dollar of sales.

In other words this ratio calculates how much money an investment firm or bank is making on its investing operations. Profit Per Unit 250 237.

1

3

Gross Profit Margin Vs Net Profit Margin Formula

Income Statements Company Accounts Lesson Objectives L By

Gross Profit Margin Formula Definition Investinganswers

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Profit Margin Formula Meaning Example And Interpretation

Gross Profit Margin Define Calculate Use Interpretation Of Higher Lower